Robert Ambrose, co-founder, Caretta Research, explains how media companies are focused on getting their existing operations working more effectively and remain very cautious about any “new trends” that do not directly grow revenue or cut costs.

What industry trends have particularly stood out for you in 2023, and why?

Looking past the hype to understand the realities of the media tech market has never been more important than in 2023. The disruption of the Covid period has given way to the harsh realities of a fundamentally different, and tougher, media business.

Overall, Caretta Research’s market sizing data for media tech in Caretta Portal sees 2023 closing with $85 billion in revenue, up just 1.4% from 2022.

No doubt that the frothiest buzz of 2023 has been AI. From a topic barely mentioned a couple of years ago, no product at IBC ‘23 was complete without the AI box being checked. But at Caretta we care about digging beneath the hype to speak with buyers and analyse data about the real potential for new technology in the industry. We also track every known deployment of technology, revealing where media companies are really investing their tech budget.

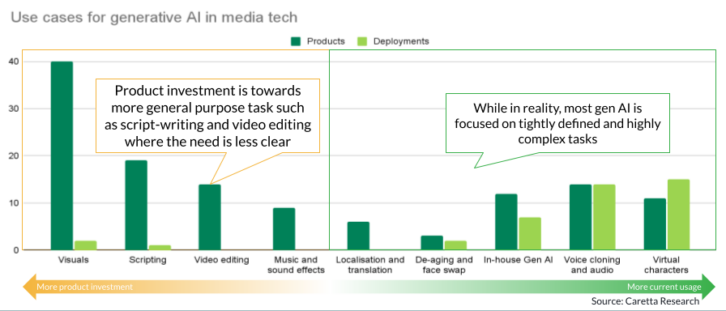

This reveals a disconnect: while vendors are tending to invest more in general-purpose AI tools — functions like script writing and video editing — buyers are focused on much tighter use cases — such as voice cloning and creation of virtual characters.

It’s often the simplest use cases that can speed up or eliminate the drudge work in workflows that are most welcome. Video professionals are understandably far more cautious about adopting AI tools that potentially replace their own creativity.

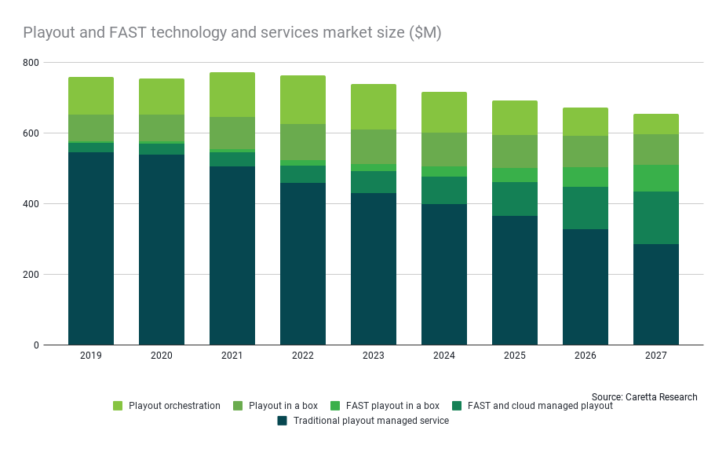

FAST has been heralded as the saviour of the industry in 2023, and there’s no doubt that it’s attracting real investment from content owners looking to exploit their catalogues in a free streaming model.

It takes away many of the traditional pain points of both launching a linear channel (expensive playout services are replaced by low-cost software), and of operating a streaming service, as technology partners like Amagi, Frequency and Wurl do the heavy lifting, and device makers like Roku and Samsung provide the frontend.

But, and it’s a big but, FAST is not a magic money-making machine — in fact the opposite, overall it’s reducing value in the industry. There are only so many viewing impressions to go round, and while FAST services can create some additional viewing hours, they are ultimately poaching ad revenue and eyeballs from high-value TV channels (and SVOD services). For the technology and service providers, it’s structurally changing expectations about costs and service levels for channel playout.

For content owners, while FAST can and does create incremental revenue, their free streaming TV services are often more about brand building, promoting paid-for content, or testing new markets.

Importantly 2023 has been the year that sustainability has finally worked its way up the agenda to be — almost — mainstream, driven primarily by larger buyers with corporate carbon and sustainability objectives to deliver. They are now baking those into procurements.

Vendors are responding, and it was notable that green credentials were very much on display by many vendors at the 2023 NAB Show. But for most buyers it’s still a “nice to have”.

It’s financial pressures, rather than environmental concerns, that are accelerating the adoption of more environmentally-friendly products. Our research shows that the industry is increasingly recognising that cutting carbon emissions — for example by reducing expensive compute processing capacity — is good for business.

What impact are you seeing those trends having on the media and entertainment industry?

Beneath the headline market sizing data, there’s turmoil. Finding success in this complicated market depends on having up-to-date, accurate and actionable data to identify the hotspots. Looking past the noise of buzzword topics like AI and FAST to identify who’s actually spending money on what tools.

For example, as traditional pay-TV technology gives way to OTT delivery, it’s bad news for set-top boxes and conditional access systems (CAS), reflected in softening revenues for vendors in those segments. Meanwhile the market for FAST, connected TV (CTV) technology and ad insertion is expanding rapidly.

How do you see those trends developing further in 2024?

A focus on profit, not just revenue, has been the 2023 mantra for streamers and platform operators, and we expect a doubling down on efficiency in 2024.

Expect more integration between linear and streaming tech stacks, and far more efficiency on the content supply chain needed to support them.

With the focus on advertising revenue catalysed by AVOD and FAST, media companies that are used to controlling their own ad sales are increasingly unhappy about the huge slice of revenue (and control) being syphoned off by the complex ad tech ecosystem. We’ll see more efficient ad tech solutions tailored to the needs of video platforms coming to the fore.

On efficiency, cloud live production, or “production in a box” is poised to become mainstream, as the logical progression from remote production (REMI). In 2023 we’ve already seen vendors investing in acquiring and developing these products and they are maturing as a result. Software-based solutions that can replace much of the production hardware needed for live shows will move up the food chain to bigger and more valuable live productions, and will even find their way into news production as buyers seek to have more flexibility in their operations and less dependency on physical control rooms in expensive real estate.

Do you expect to see any new trends within the industry in 2024, and what will they be?

Media companies are focused on getting their existing operations working more effectively and they remain very cautious about any “new trends” that do not directly grow revenue or cut costs.

Plenty of buzzword trends from the past few years — metaverse, web3, 8K resolution — have failed to gain adoption because they don’t add to the bottom line in a fiercely-competitive and complex media market.

At Caretta Research, we care more about the investments people are actually making, and we’ll judge the prospects for any new trends that emerge on that basis.