The decision to move this year’s FIFA World Cup to the winter means TV will be one of the biggest winners in terms of the expected $6.5 billion this year’s tournament is expected to generate.

According to S&P Global, Qatar 2022 will surpass all previous tournaments and be four times the revenue seen in Korea and Japan in 2002. It will generate $1.3 billion more than the last World Cup held in Russia in 2018.

In its analysis of the last complete four-year World Cup cycle that led up to Russia 2018, S&P reported just under half of FIFA revenue came from broadcasting rights fees and an additional 26 per cent came from marketing rights with sponsors signing contracts to associate with the event.

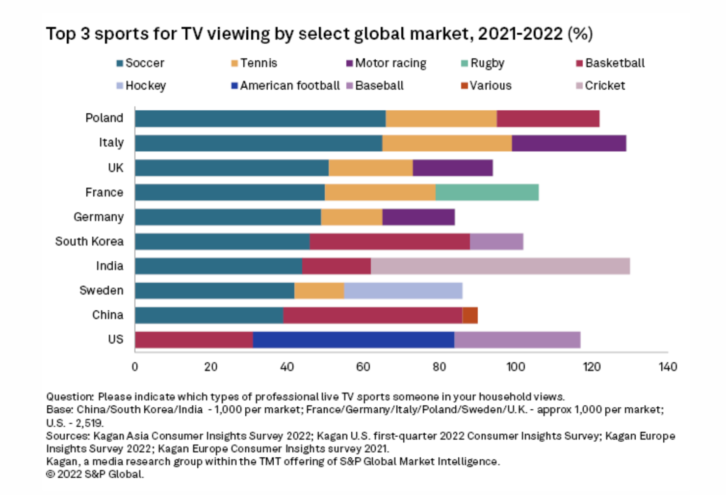

S&P’s research found football is the most popular live sport in eight of 10 major global markets and in the top three for nine markets, including Poland, Italy, the UK, France, Germany and Sweden.

One of the advantages of holding the World Cup at the end of the year is that the fourth quarter is a particularly lucrative time for advertising in the run up to Christmas, added the research.

“The fourth quarter traditionally outperforms all other quarters across most markets as major campaigns target the holiday period when high levels of consumer goods transactions occur,” S&P said.

Although the event has been sold to pay-TV and free-to-air channels worldwide, some markets, particularly in Europe, have passed legislation to ensure that the games in a home nation are available free to air, a consideration when estimating TV advertising revenues. Time zones are another consideration: with Qatar two hours ahead of most European countries, most matches will take place during primetime.

S&P concluded: “Overall, television is the largest beneficiary during the World Cup, but interactive experiences and mobile viewing mean that ad budgets will trickle down to online video and social media as well. According to Magna Global’s June 2022 Global Ad Forecasts, cyclical events, which include the U.S. midterm elections and the World Cup, have boosted projected year-over-year global advertising growth for TV alone to 3.9 per cent, from 2 per cent in their absence.

“However, their absence in 2023 means linear TV advertising will decline year over year by 3.7 per cent globally. Global advertising expenditure will naturally slow down in 2023 following a year of cyclical events, economic turmoil and declining GDP performance.”