Every third viewing hour is now spent watching on-demand TV and video, according to the latest edition of the annual Ericsson ConsumerLab TV and Media Report. Based on interviews with over 22,500 people, findings in the Report are representative of 680 million consumers, making it the largest study of its kind in the TV industry.

Consumers now spend six hours per week watching streamed on-demand TV series, programmes, and movies – this has more than doubled since 2011. With recorded and downloaded content added to the equation, today 35 per cent of all TV and video viewing is spent watching VoD.

Further findings highlight the considerable growth in consumers watching video on a mobile device: 61 per cent watch on their smartphones today, an increase of 71 per cent since 2012. When taking tablets, laptops, and smartphones into consideration, nearly two thirds of time spent by teenagers’ watching TV and video is on a mobile device.

At the same time, user-generated content (UGC) platforms account for a growing share of consumers’ TV and video viewing. Close to one in ten consumers watch YouTube for more than three hours per day, and one in three now consider it very important to be able to watch UGC on their TV at home. The increasing prominence of UGC-rich platforms, like YouTube, has resulted in a popularity boost for educational and instructional videos, with consumers watching an average 73 minutes of these videos per week, the study finds.

“The continued rise of streamed video on demand and UGC services reflects the importance of three specific factors to today’s viewers: great content, flexibility, and a high-quality overall experience,” said Anders Erlandsson, senior advisor, Ericsson ConsumerLab. “Innovative business models that support these three areas are now crucial to creating TV and video offerings that are both relevant and attractive.”

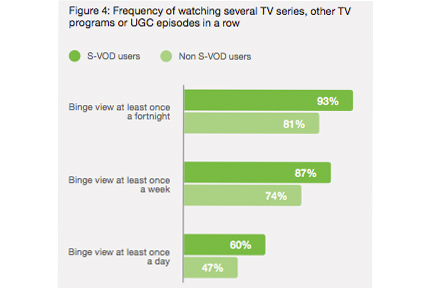

Bing-watching has become a key part of the TV and video experience, and is prominent among Subscription Video on-Demand (SVoD) users of services such as Netflix, Amazon Prime, and HBO, of whom 87 per cent binge-watch at least once a week.

The report also highlights consumer issues: half of those watching linear TV say they can’t find anything to watch on a daily basis: as many as 62 per cent of consumers aged 25–34 face this challenge on a daily basis, and consumers feel that recommendation features are simply not smart or personal enough.

The popularity of linear TV remains high, mainly due to its access to premium viewing and live content, like sports, and its social value. Linear viewing is linked to age: 82 per cent of 60–69 year olds say they watch linear TV on a daily basis, while only 60 per cent of millennials (those aged 16–34) do so.

The Report asserts that non-believers in traditional pay-TV may eventually change their minds. For ‘TV cord-nevers’ (consumers who have never had a pay TV subscription) it is difficult to understand the value as it is offered today. Long binding times, inflexible packages and high costs and advertising cause 50 per cent to believe they will not pay for it, even in the future. However, 22 per cent of cord-nevers are already paying for over-the-top (OTT) content services, indicating a willingness to pay for subscription TV, albeit with a different bundle approach.

Three specific areas that influence a consumer’s service experience are highlighted in the Report: great content; flexibility; and a high quality overall experience. Supporting these three areas will be crucial when creating the 21st century TV and media offering, and bringing it to consumers, concludes Ericsson.