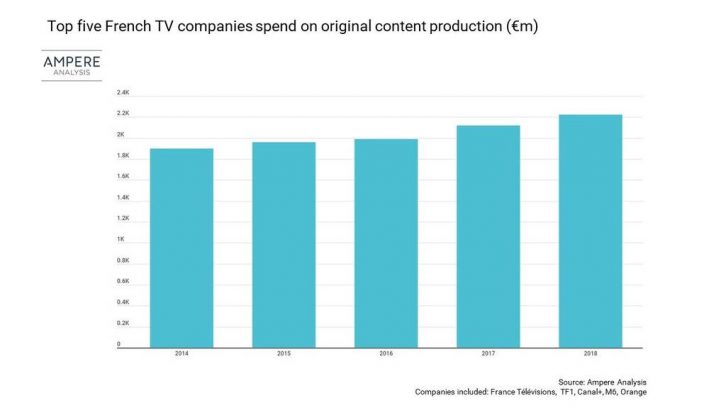

Ampere Analysis has revealed that French broadcasters spent €5.4 billion on content last year, 40 per cent of which was dedicated to originals.

The increasing spending of the big five French players (France Télévisions, Canal+, TF1, M6 and Orange) is designed to compete with Netflix’s five million-strong subscriber base in the country.

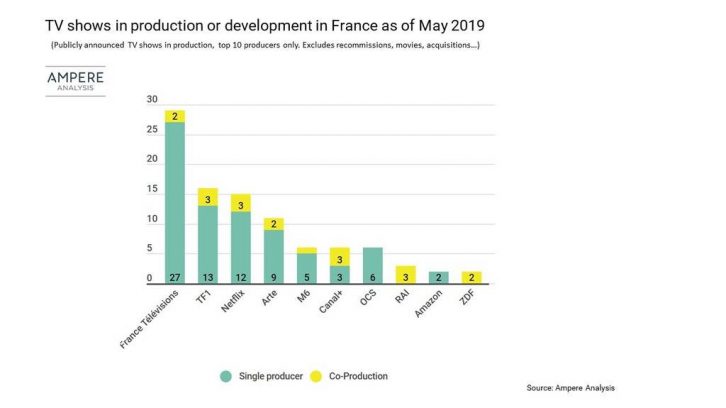

Meanwhile the local players have reduced their spend on content acquisition in order to redirect funds towards original content, with 106 new local shows in production (as of May 2019).

Attempts by the French broadcasters to diversify their revenue streams include:

- Canal+ launched a new SVoD service dedicated to younger audiences, supported by shows such as Fleabag remake Mouche

- TF1 plans to enhance its catch-up platform MyTF1 with new advertising inventory and exclusive content

- France Télévisions is focusing on international partnerships with other broadcasting groups

- Orange has created a new division that merges its pay-TV and film operations, aiming to produce high-end series

Ampere added that French OTT subscriptions are growing rapidly, leading the top three broadcasters (France Télévisions, TF1 and M6) to create the new SVoD platform SALTO.

“French consumers are adopting digital TV subscriptions quickly, and the local broadcasters know they must respond fast if they are to protect their revenues in a changing media landscape,” said Léa Cunat, analyst at Ampere Analysis.

“With increasing competition from international behemoths Netflix and Amazon Prime Video, fierce price wars for exclusive sports content, and flat ad revenues, there’s no shortage of tactics and strategies being employed to stay in the game.

“But the emphasis put on original content encourages creativity and the emergence of new talents. It’s a fascinating market to watch as it transforms,” she added.